A leading fitness equipment maker hits its stride with Alloy

The speed and flexibility of Alloy POS analytics enabled this consumer brand to make more timely decisions for new product success and inventory management.

ViewIn an MIT briefing on The Impact of COVID-19 on Business and Supply Chain last week, professor Yossi Sheffi recommended that one of the actions companies should start taking right now is “plan for the recovery.” I agree with the need to start thinking longer-term now, but is it really as simple as recovery? Someday, hopefully soon, the crisis will be “over” and the world will return to normal?

While supply can recover as factories come back online and transportation routes are reinstated, I believe demand will be different. The Coronavirus crisis will have both immediate and long-lasting effects on consumer demand, from what they buy, to how much they buy and how they buy it. As a result, traditional demand signals, like customer orders, will no longer be reliable business indicators as retailers and other trading partners struggle to catch up to the new normal, and the past is no longer a good predictor of the future.

Take hand soap as an example. Consumers will logically continue to consume more soap as they continue to wash their hands more often, so demand will go up compared to before. A less straightforward example is breakfast foods. Will consumers buy more cereal or pancake mix now than before, as they develop a habit of eating breakfast at home during this period, and if so, what will that do to demand for on-the-go breakfast bars in the future? Also, will they continue to head to the store to stock up, or having tried grocery delivery, will they stick with the newfound convenience?

As a result, traditional demand signals, like customer orders, will no longer be reliable business indicators as retailers and other trading partners struggle to catch up to the new normal, and the past is no longer a good predictor of the future.

One of Alloy’s customers, a consumer electronics executive, recently shared with me that he also believes consumer behavior is going to change much faster than anybody thought, and change for good. For example, Best Buy stores are now all closed and shopping has quickly shifted online. Even when stores reopen though, he questions whether consumers will return in the same numbers to experience and purchase products. Touching the same demo product everyone else has and standing in line to check out can suddenly seem unsafe and unnecessary after experiencing an alternative.

The research backs him up too: In February 2014, a three-day strike on the London Tube forced commuters to experiment with new routes. Afterward, around one in 20 stuck with their new commutes—and that’s a very small change compared to what we are experiencing today!

In the short, medium, and long-term, the size and shape of demand will continue to evolve. To be ready to respond, consumer goods manufacturers need to get closer than ever to the end consumer: identify shifts as soon as they start to happen, and break them down by product, channel, and partner to pinpoint how the business is affected and determine the right course of action.

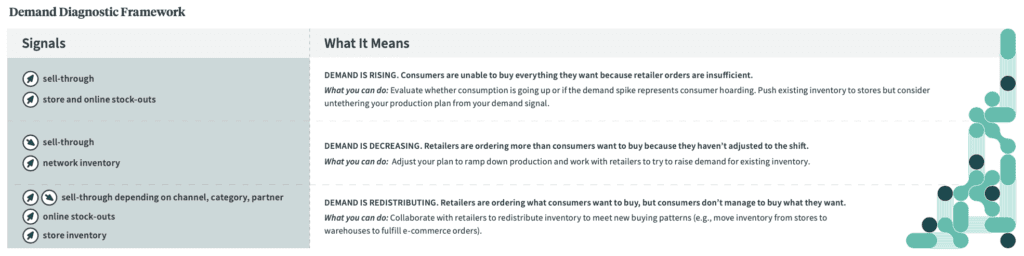

In this post, we lay out a framework to help you quickly spot when demand for each of your products is rising, falling, or re-distributing. Then by de-averaging the impact, sales and supply chain teams can act swiftly to optimize inventory management and partner effectively with retailers.

The framework doesn’t require waiting for retailers to make the first move—a risky proposition that could mean being too late to respond to demand shifts, mis-allocating inventory, or even moving in the wrong direction as retailers can over- or under- react to fluctuations and anomalies. It takes into account three different definitions of “demand”:

When consumer demand is stable, these three demand metrics are all about the same in an efficiently operating supply chain (seasonality aside). Consumers are able to actually buy just about everything they want (unconstrained demand ≈ sell-through), and retailers are ordering from manufacturers just about enough to meet that demand (sell-through ≈ sell-in). That may still be the case for certain categories that are not really affected by the pandemic, though I struggle to imagine any.

More telling is when you can see differences between these three metrics. Their relative relationship can tell you whether the business is rising, falling, or redistributing, and help you take the right actions the first time.

Rising consumer demand

If consumers would like to buy more than they are able to based on what retailers are ordering (unconstrained demand > sell-in), the news is mostly good: in the current situation, this product is more desired by consumers than before. Your top priority is to figure out how to best allocate supply, and look out for long-term growth patterns that might justify broader shifts in production.

Falling consumer demand

Conversely, if orders are out-pacing what consumers are buying or would like to buy (sell-in > unconstrained demand), it means consumers are shifting away from your product at the moment. Demand is likely dropping, and you need to reflect that information back up through your production and to your suppliers, as well as monitor your current inventory levels.

Redistributing consumer demand

When retailers are ordering what consumers would like to buy (sell-in ≈ unconstrained demand), but surprisingly, what consumers actually manage to buy (sell-through) is lower, an underlying shift is happening. It’s the old cliché in action, “the right product, in the right places, at the right time.” In this case, your products are not in the right places for consumers to be able to buy them.

So far, this scenario has been the most common impact on demand that we’ve seen from COVID-19. Across our customers, whether they’re in CPG, consumer electronics, automotive, or toys, we keep seeing a similar situation play out: a retailer has a sizable drop in point-of-sale (POS), say 20%, and may even cut orders because, in aggregate, there is plenty of inventory left. However, warehouses used to fill online orders are running dangerously low because most sales have shifted to e-commerce. Looking at total inventory doesn’t help when it’s all stuck in closed stores.

In this case, consider asking for additional e-commerce orders, or even for reverse logistics if it’s a feasible way to rebalance inventory. Examine each of your partners and look at how they are adjusting to the demand redistribution. If needed, consider offering up a form of collaborative planning, forecasting, and replenishment (CPFR) to help ensure the right products are getting to the right places.

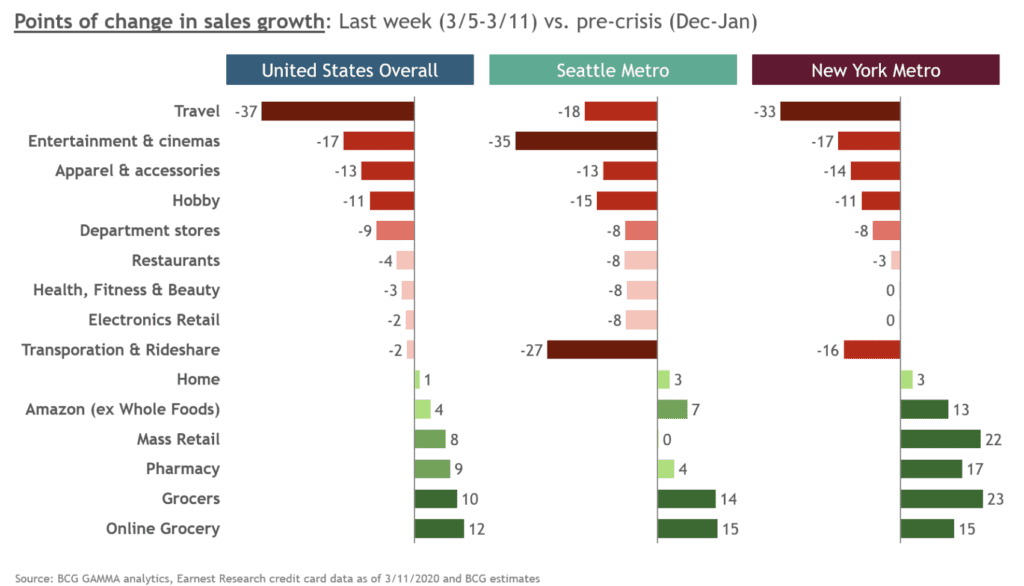

When applying this framework, breaking things down to a granular level is key. What’s happening will likely not be the same for each of your products, partners and channels, so high-level averages can be misleading or hide useful insights. BCG’s Consumer Spend Pulse has been monitoring sales growth in key categories in recent weeks vs. pre-crisis, and shows not only a difference by category, but also by metro areas, offline vs. online segments, and brand—making it critical to “de-average the impact.”

At a minimum, you should always be de-averaging your demand along three dimensions:

Additional dimensions that may be useful for your business include:

This detailed analysis has helped some of our customers gain insight into how demand is moving in different directions for different parts of their business, and where they need to focus their efforts. For example, if demand for your home office products category is rising but demand for school supplies is falling, devote more resources to the former while keeping an eye out for rising Weeks of Supply in the latter. Or if most sales are happening online, focus on ensuring adequate inventory levels at the warehouses they’re fulfilled from instead of store in-stock levels.

From crisis response to the new normal, a current and precise picture of consumer demand is one of the most valuable tools you can have. Because if you think your demand hasn’t started to shift yet, maybe it’s because you’re waiting for orders to reflect it. Or maybe it truly hasn’t, but don’t you want to know the moment it does?

This imperative isn’t just for sales either. Now more than ever, supply chain teams also have to be close to the end-consumer. If we can put a positive spin on the COVID-19 pandemic, perhaps it can be the light it has shown on supply chain management and its importance to our day-to-day lives.

So ensure teams throughout your organization have easy access to sell-through data—made available on a daily basis, and broken down by at least category, channel, and partner to support de-averaging analysis. Most retailers already share point-of-sale in some form or another, and there have even been calls for additional retail data sharing to help suppliers during this critical time. Traditional feedback mechanisms, while familiar, are just too slow, and maybe even incorrect, to run a business amid changing demand.

The speed and flexibility of Alloy POS analytics enabled this consumer brand to make more timely decisions for new product success and inventory management.

ViewThe global confectioner mitigates waste, improves service levels and controls costs by connecting digital supply chain visibility with POS analytics.

Keep readingHow to take an iterative approach to digital supply chain transformation with real-time alerts that motivate teams to collaborate on issue resolution

Keep reading