Alloy.ai Consumer Goods Index – April 2023 Edition

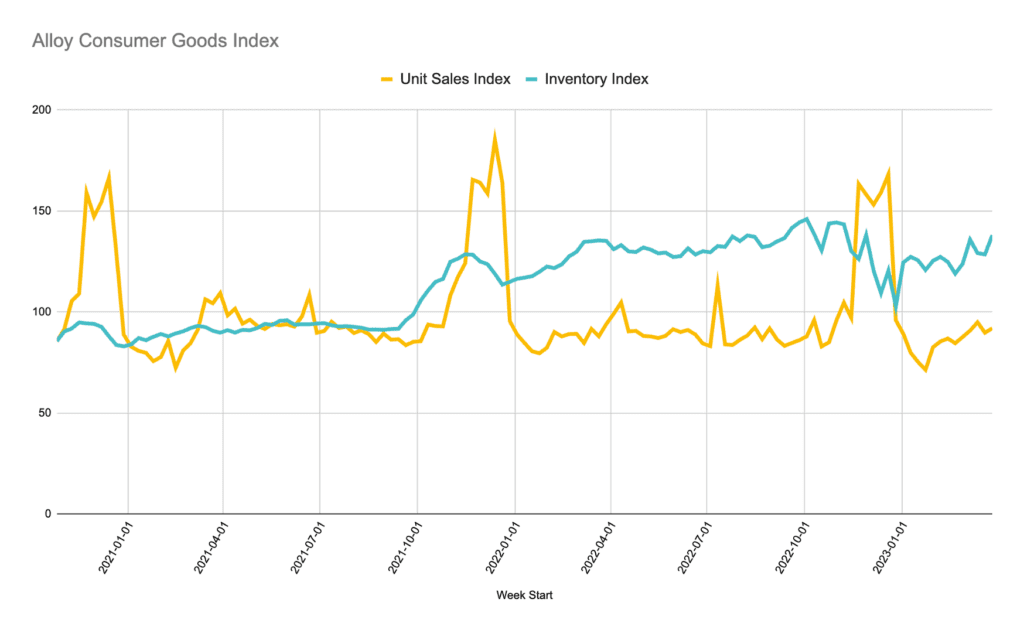

Deltas in sales over time and inventory totals are critical leading indicators for the health of the consumer goods industry. Retailers and consumers alike are impacted by deviations and volatility in the consumer goods supply chain. The Alloy.ai Consumer Goods Index tracks 40M SKU-location combinations across both retail and ecommerce, giving a view into sales and inventory trends across industries. Use this data to understand the trends, isolate the impact of wide-scale events and predict future peaks and valleys.

Note: All consumer goods data within this dashboard has been generalized to protect the anonymity of the companies involved.

Table of contents

Alloy.ai Consumer Goods Index — April, 2023

Consumer goods trends in April, 2023

Sales rates appear steady despite economic uncertainty

Fears over rising inflation rates and bank collapses have so far not subdued consumers’ overall confidence or dampened spending habits. Sales rates have improved ~2.5% for the month of March YoY, though are down just over 7% for the month of March between 2023 and 2021. Banking turmoil which led central bank officials to downgrade economic forecasts, in addition to the Federal Reserve’s announcement on an anticipated “mild” recession by year-end, is anticipated to contribute to lower sales rate recovery following the pandemic during the rest of 2023.

Sustained excess inventory is once again a top fear

Excess inventory, a hot topic of concern in 2022 due to the pandemic-related bullwhip effect, had appeared to be flattening following a period of decline during the 2022 holiday shopping season. Concerted efforts by many retailers to reduce inventory through holiday sales and promotions appear to have been unsuccessful in lowering the overall inventory rates. Inventory rates have remained essentially unchanged YoY between 2023 and 2022 and continue to be more than 45% higher than rates in March 2021. Many companies are citing warehousing costs, rent and labor to be their highest cost-centers. These chronic excess inventory issues are expected to contribute to lower-than-expected earnings in upcoming quarters with costs being passed along to consumers.