Direct import is the term used to describe a specific method of replenishment planning. It involves a retailer receiving products directly from the manufacturer or supplier in another country. This process saves on domestic warehousing and reduces costs to vendors, which reduces costs to retailers. In many ways, importing products directly can save time in transit, help to keep out-of-stocks at a minimum, and result in increased revenue for both parties.

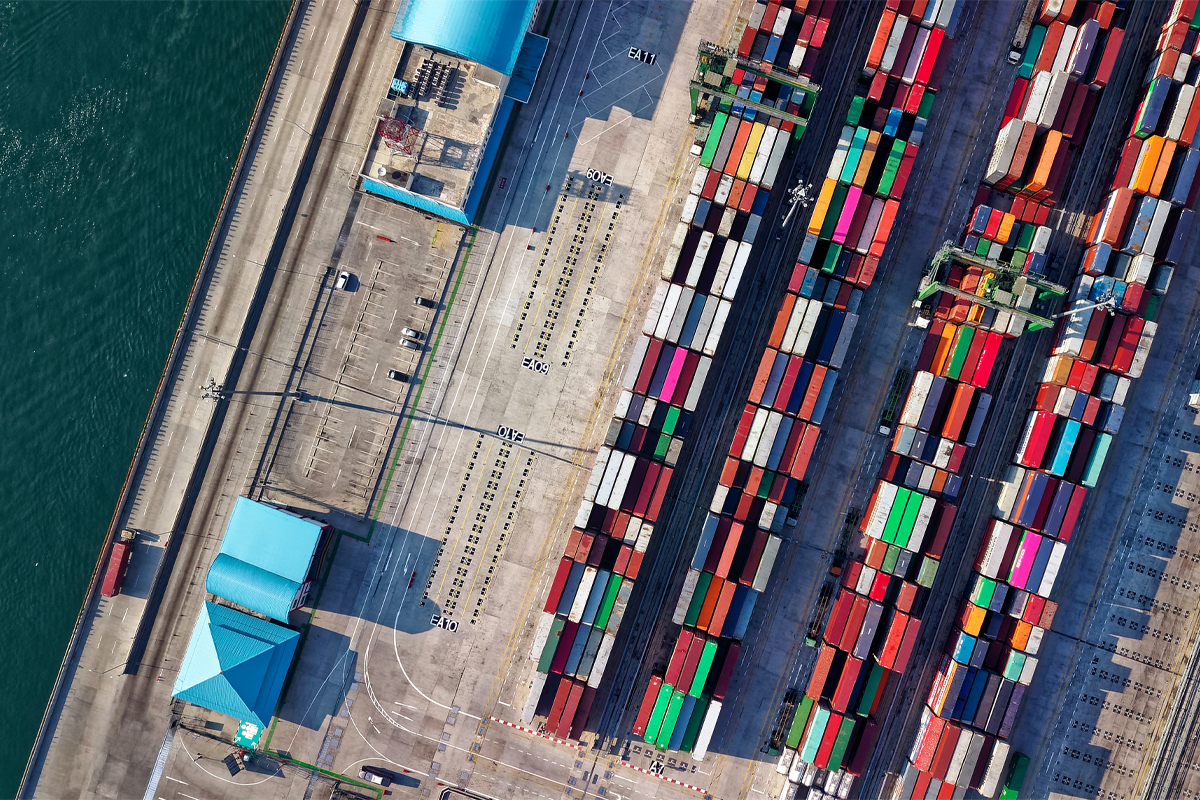

Retailers may place direct import orders with offshore suppliers multiple months in advance of arrival. These orders generally arrive by container and are transported directly from the manufacturer to the retailer’s distribution center. Brands don’t need to hold the inventory, may not need to arrange transportation, and don’t need to forecast for that subset of products. Since intermediaries are eliminated, so are many costs associated with complex supply chains.

Direct import relationships are common for retailers like Amazon and Target and span industries, including toys, games, tools, and consumer electronics. Often, retailers rely on a combination of direct imports and traditional methods of replenishment to keep their shelves stocked. These traditional methods usually involve the brand anticipating the replenishment needs of its retailers and importing the finished products. Products are stored in a domestic warehouse before being shipped to the retailer’s DC.

The Challenges of Direct Import

In many ways, it’s easier for brands to have a direct import relationship established with their retailers. That doesn’t mean there aren’t any challenges, however. One of the main roadblocks brands face is trying to harmonize data surrounding a specific SKU when that SKU is imported directly, as well as replenished from their own domestic warehouse. In other words, keeping track of and analyzing a single product that has multiple identifying codes is a challenge.

Manually Tabulating Direct Import and Primary SKU Replenishment

Different organizations may handle this challenge in different ways. Some will likely manually attempt to track and harmonize retailer imports with their own order fulfillment to retailer DCs. They may leverage multiple Excel spreadsheets with innumerable VLOOKUPs to try to correlate products that the retailer imported directly with their primary replenishment SKU. This takes time, but it can help organizations plan and forecast demand from multiple origins.

“Fire-Fighting” When Replenishment Needs Deviate From the Plan

Other consumer brands will exist in a constant state of firefighting. They may try to replenish store shelves only when stock has been completely depleted or a build-up of inventory becomes unbearable. This visibility may only come from conversations with the retailer and is much more reactive than proactive. To a brand, the direct import SKUs often present similarly to phantom inventory. This is because they have limited visibility within their own internal systems to view those orders.

The lack of visibility makes it challenging for brands to determine the right amount of inventory that needs to be replenished through their own warehouses. Other metrics and scorecards, which help brands run successful businesses, are also hard to calculate. Product identifiers often don’t match up between internal systems and the data fed back via the retailer.

Using Technology to Harmonize Direct Import with Traditional Replenishment Data for Improved Planning

Brands that struggle with wrangling their direct import and primary SKU data can benefit from the use of technology. Demand planning software like Alloy Planning can help supply chain professionals consolidate this direct import data into a single system of truth. Brands can better forecast demand from multiple origins in the same place and analyze trends by a specific product. This can be done without breaking the data up into separate categories based on the replenishment method.

For example, Target might directly import two shipping containers of a consumer goods company’s top 10 best-performing SKUs. That company might also fulfill some of Target’s orders via its own domestic warehouses. When the brand puts together a demand forecast, they need to be able to account for the units that Target has on hand and has imported directly from the supplier or manufacturer. With Alloy, regular SKUs and sub-SKUs indicating a direct import item are harmonized so that they can be tracked in parallel. This means that a brand can see what is in channel by product and forecast replenishment needs with full visibility.

Creating a Single Replenishment Plan

With the help of technology, brands can create a single replenishment plan for a product under multiple identifiers. They can generate reports for these products to see facts like out-of-stocks across retailers, how much should be shipped to accommodate real-time sell-through patterns, and where there might be opportunities for additional shelf space. Being able to generate a single forecast for replenishment helps planners continually address changes to their plans and allows for a more agile supply chain that isn’t reliant on manual processes.

Abby Carruthers

Abby Carruthers is Alloy.ai‘s Director of Product. She manages Alloy.ai’s predictive and prescriptive products, including forecasting, simulations, replenishment recommendations, and more. She has a background in Client Solutions; helping customers get value from B2B SaaS products across the supply chain and retail analytics space.