- Franklin Morris

The Consumer Goods Guide to Modern Commerce | Section 5

Solid financial and operational management form the backbone of any successful consumer products company. While products and marketing efforts attract attention, effectively managing cash flow, pricing, margins, and the supply chain is crucial for sustained growth and profitability. This section covers essential practices for managing cash flow, optimizing pricing strategies, protecting margins, and establishing reliable supply chain and inventory management systems.

Table of Contents

Managing Cash Flow in Consumer Goods

Effective cash flow management is critical, especially for consumer goods companies, which typically incur inventory costs long before sales revenues are realized. Even profitable companies can fail if cash flow is mismanaged.

Understanding the Cash Conversion Cycle (CCC)

The cash conversion cycle measures the period from when money is spent on inventory until it is collected from customers. Shortening this cycle enhances cash flow. Accelerating inventory turnover by avoiding overstocking and forecasting demand accurately ensures that cash invested in inventory returns quickly. Negotiating favorable payment terms, such as paying suppliers later and encouraging faster customer payments with early-payment discounts, further improves the cycle. Prompt invoicing and systematic follow-ups on overdue payments also accelerate cash inflows.

Strategic Use of Financing

Short-term financing can bridge temporary cash gaps, enabling the fulfillment of large orders and maintaining adequate inventory levels. Bank lines of credit, secured by inventory or receivables, offer flexibility. Inventory financing specifically covers inventory purchases, using the inventory itself as collateral. Factoring—selling receivables for immediate cash—is useful but costly. Purchase order financing allows companies to produce goods for large orders without upfront cash, while trade credit insurance mitigates the risk of extending credit terms broadly. The key to using financing effectively is ensuring the returns generated exceed financing costs, carefully monitoring financial metrics like interest coverage and leverage ratios.

Budgeting and Forecasting

Creating regular cash flow projections highlights potential shortfalls, allowing proactive financial management. Clearly projecting cash inflows such as sales revenue, loans, and investments against outflows like inventory purchases and operating expenses reveals potential gaps ahead of time. This foresight enables strategic adjustments or timely financing arrangements. Maintaining cash reserves equal to at least 2-3 months of operational expenses provides a buffer against unforeseen challenges.

Expense Management and Inventory Control

Minimizing fixed costs provides flexibility, particularly during early growth stages. Using contractors or part-time employees instead of permanent hires reduces fixed payroll obligations. Avoiding unnecessary overhead such as large office spaces further preserves cash. Effective inventory management involves regularly monitoring turnover rates against industry benchmarks. Recognizing excess inventory as idle cash encourages proactive inventory management to prevent unnecessary financial strain from storage or depreciation costs.

Aligning Inventory Payments with Revenue Cycles

Aligning inventory payments closely with revenue cycles is critical for stable cash flow management. Direct-to-consumer businesses often have immediate cash inflows, making upfront supplier payments more manageable. Wholesale models, however, require precise alignment of supplier payment terms with customer receivables. Negotiating lower upfront deposits with suppliers and carefully managing customer credit by requiring prepayments or immediate payments from smaller or new retailers helps maintain financial stability.

Planning for Seasonality

Seasonal fluctuations significantly impact cash flow management in consumer goods businesses. Companies must anticipate periods of heavy expenditure, such as inventory buildup prior to holiday seasons, followed by significant inflows post-season. Reserving excess cash during peak revenue periods ensures financial stability during lean months. Arranging seasonal increases in credit lines may further support inventory management during high-demand periods.

Monitoring Key Cash Flow Metrics

Regularly tracking essential cash flow metrics, including Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), and Days Inventory Outstanding (DIO), is critical. These metrics directly influence the cash conversion cycle. Addressing issues promptly—such as excess inventory indicated by high DIO, delayed collections indicated by high DSO, or opportunities to extend payment terms indicated by DPO—ensures continuous improvement in cash flow management.

Effective cash flow management in consumer goods involves precise timing, disciplined financial practices, and proactive planning. While profitability and sales growth are important, cash flow management remains the critical lifeline ensuring long-term stability and sustainable growth.

Pricing and Margin Strategies

Setting the right pricing and maintaining healthy margins are essential to financial sustainability. Pricing directly impacts revenue per unit, while margin (price minus cost) determines the profitability from sales after covering overhead and expenses.

To set viable prices, brands must have an in-depth understanding of their Cost of Goods Sold (COGS), including manufacturing, packaging, duties, taxes, and freight. Equally critical is evaluating channel-specific costs such as distributor margins, retailer margins, marketplace fees, and direct-to-consumer (D2C) fulfillment expenses. Pricing strategies often vary—some brands adopt cost-plus pricing, targeting a margin over production costs, while others employ value-based pricing, reflecting perceived consumer value and brand positioning.

Example cost structure breakdown by Channel:

| Cost Component | D2C (Own eCommerce & Retail) | Wholesale |

|---|---|---|

| Product Costs (Manufacturing, Raw Materials) | 25-40% | 25-40% |

| Packaging Costs (Retail-ready, protective) | 5-10% | 3-7% |

| Fulfillment & Shipping Costs (Warehousing, last-mile delivery) | 15-25% | 5-10% (Retailers often handle logistics) |

| Retailer / Platform Fees (Chargebacks, slotting fees, marketplace commissions) | 0% (unless using third-party fulfillment) | 30-50% (wholesale margin given to retailer) |

| Customer Acquisition & Marketing (Ad spend, SEO, promotions) | 20-40% (Paid ads, influencer marketing, etc.) | 5-15% (Some marketing but retailers drive traffic) |

| Returns & Chargebacks | 5-10% | 2-5% |

| Technology & Payment Processing (Shopify, WooCommerce, credit card fees) | 3-5% | 0-2% (Handled by retailer) |

| Net Profit Margin | 5-25% | 10-20% |

Margin erosion, resulting from rising costs, promotional discounts, or retailer demands, requires careful management. Before raising prices, brands should explore operational efficiencies, cost engineering through product reformulation, and diversification of sales channels. If price increases become necessary, clearly communicate the rationale to stakeholders, linking adjustments to added consumer value or product improvements.

Additionally, implementing strategic promotions rather than frequent discounts can help maintain healthy margins. Critical financial metrics to monitor include gross versus net margin, break-even points, and contribution margin by channel. Regular testing of pricing elasticity through incremental increases can mitigate consumer pushback, ensuring price adjustments remain acceptable.

Ultimately, robust pricing and margin management is about deeply understanding costs, actively managing channels, and maintaining pricing power. Healthy margins fuel marketing, innovation, and sustainable business growth.

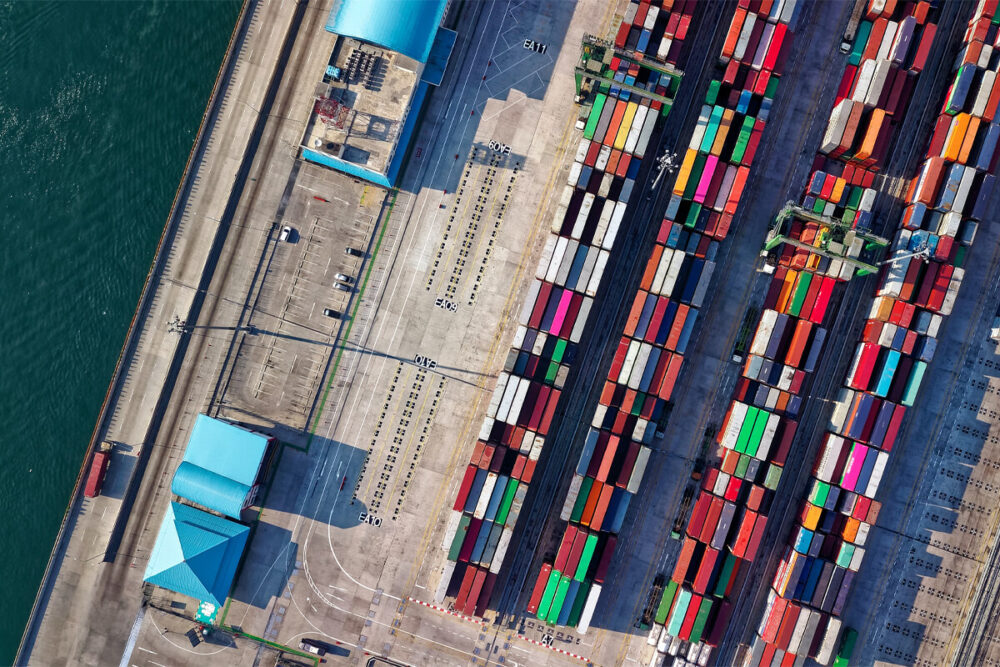

Supply Chain Planning and Inventory Management

As your sales grow, operational complexity increases significantly. Effective supply chain planning and inventory management ensure you consistently meet consumer demand without unnecessary inventory excesses.

Four Key Principles:

1. Demand Forecasting

Accurate demand forecasting is critical for supply chain planning. Use historical sales data, market trends, seasonality, and retailer insights, updating forecasts regularly (monthly or even weekly). Adjust quickly based on actual sales data and collaborate with key customers for enhanced accuracy. For new products, start with conservative estimates based on analogous products or market testing, then adapt rapidly to actual market feedback. Always align forecasts closely with production timelines and supplier lead times.

2. Inventory Management

Effective inventory management balances the risks of shortages against the costs of surplus. Implement robust systems or structured spreadsheets to monitor stock levels, incoming shipments, and outgoing orders. Set clear reorder points based on demand forecasts and supplier lead times, and maintain calculated safety stock to buffer against unexpected fluctuations. As your operation scales, optimize inventory placement strategically (e.g., regional warehouses, retailer hubs) and proactively manage aging stock through targeted promotions or bundling.

3. Production and Procurement Planning

Align production and procurement closely with your forecasts. Schedule production batches strategically to balance economies of scale against inventory carrying costs. Clearly communicate demand expectations to suppliers and secure additional production capacity well ahead of peak seasons. Internally, manage workforce flexibility by considering overtime or temporary staffing to handle demand peaks. Where feasible, level-load production—build inventory during slower periods to avoid overstretching resources during peak demand.

4. Logistics and Distribution Planning

Ensure your logistics infrastructure can handle forecasted volumes efficiently. Contract proactively with freight carriers and negotiate favorable rates by providing predictable shipment volumes. Share detailed forecasts with third-party logistics (3PL) providers to ensure adequate staffing and storage capacity. Coordinate closely with retailers to align shipping schedules, especially during peak seasons, ensuring smooth logistics and timely deliveries.

Key Metrics to Monitor

Regularly track key performance metrics such as fill rate, inventory turnover, days of inventory on hand (DOH), forecast accuracy, and service level. Use these metrics to identify inefficiencies and proactively address issues such as inventory shortages or surpluses, refining your forecasting and inventory strategies accordingly.

Flexibility and Contingency Planning

Prepare for unexpected disruptions by developing backup supplier relationships, maintaining critical raw material reserves, clearly defining manufacturer surge capacities in contracts, cross-training staff, and establishing SKU prioritization guidelines to manage crises effectively.

Continuous Improvement

Continuously analyze operational performance to enhance your supply chain processes. Address issues promptly, refine forecasts, identify cost-saving opportunities, and evaluate inventory efficiency across locations to prevent redundancy. Empower your team to identify and implement improvements in packaging, shipping, and storage practices to boost overall efficiency and profitability.

Example Application: A beverage startup forecasting significant seasonal demand can strategically plan production and procurement schedules well in advance, securing packaging supplies and managing cash flow effectively. Adjustments based on ongoing demand insights help maintain product freshness, manage inventory efficiently, and maximize sales opportunities, demonstrating how integrated supply chain planning supports sustainable growth.

Franklin Morris

Franklin Morris is Vice President and Head of Global Marketing at Alloy.ai. He's spent his career leading brand, content and demand generation marketing for high-growth startups, ad agencies, and Fortune 50 giants, including IBM, Dell, Oracle, Rackspace, 3M, Facebook, Electronic Arts, Informatica, Sisense, and Argo Group.