- Logan Ensign

Last week, many members of Alloy’s team were in Phoenix attending the Gartner Supply Chain Executive Conference and hosting attendees at our annual conference dinner. It was an action-packed 3.5 days of learning, networking, and getting the latest scoop on digital supply chain tech.

We were especially excited to see an Industry Day track around the Consumer Retail Exchange. It provided great insight for consumer product leaders about how retailers are responding to consumer demands. There were also inspirational keynotes from Procter & Gamble’s Stefano Zenezini about how P&G is raising the bar on sustainability, Peter Hinssen on The Day After Tomorrow and how companies can become phoenixes, and Linda Kaplan Thaler on the connection between grit and success.

If you missed all or part of the conference (or if you just want to relive the experience and compare notes!), we’ve summarized our top five key takeaways from this year.

1. Retailers want suppliers to help them make better decisions.

We often hear from consumer product companies how hard it can be to influence retail buyers and replenishment teams. While that may very much be the case, we heard a slightly different story from retailers at the conference. Both the SVP Replenishment at Loblaw’s (Canada’s largest retailer) and the SVP Flow at Walmart (the world’s largest retailer) emphasized how they are sharing more data and giving more transparency to vendors in hopes of improving execution.

Retailers are recognizing that manufacturers are in the best position to manage their brand’s business and are increasingly willing to listen to them. The recommendations must still be backed by data, of course. But suppliers can really differentiate themselves by how they make use of the shared data. Key use cases they highlighted are increasing forecast accuracy and availability.

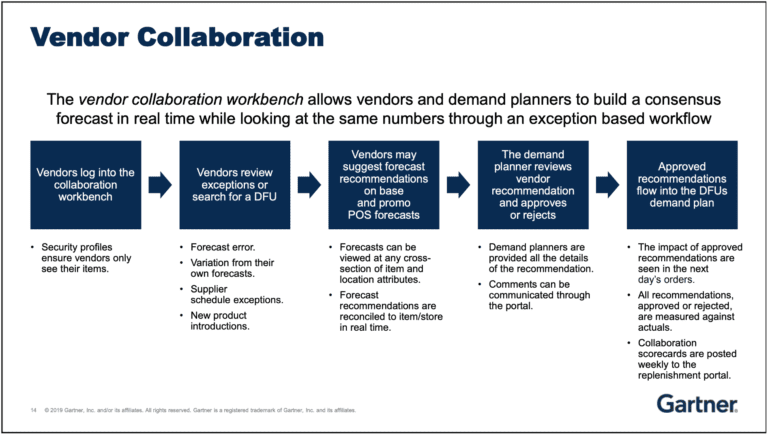

For example, Loblaw’s invites its top suppliers to a vendor collaboration workbench. In this portal, vendors can review the retailer’s forecast and suggest recommendations. Using unique insight about how a product performs across all retailers, upcoming promotion activity, etc., suppliers help improve the retailers’ forecast and ordering plan.

Walmart has garnered a lot of attention for raising its requirements (and associated penalties) for OTIF (On Time In Full). At the same time, it’s sharing more data with suppliers, asking them to leverage it to meet those new requirements and help Walmart innovate. This was such a meaty session, we did a dedicated post on it!

2. S&OP is changing, S&OE is the new cool thing.

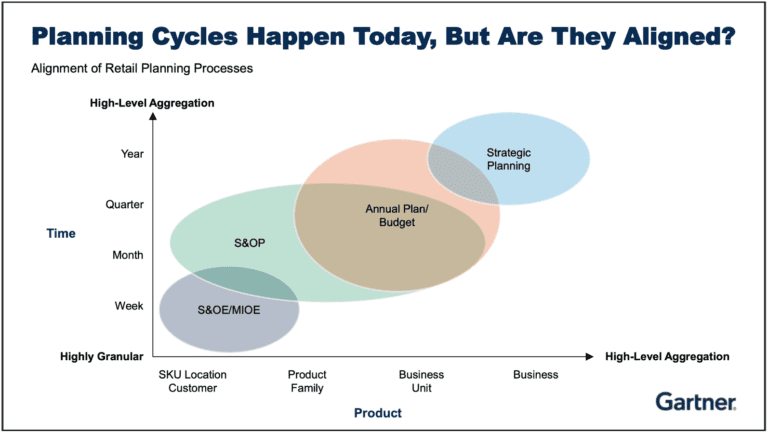

We’ve seen the rise of the term S&OE (Sales & Operations Execution) over the past year, and its buzzy usefulness was evident at the conference this year. It seems very relevant in today’s rapidly changing world. Longer-term planning can feel like a fruitless exercise, while agility and short-term execution are the name of the game.

Gartner acknowledged the need for S&OE for weekly, SKU-level planning, but still maintained the relevance of S&OP as well. Each has its place, and to quote a Gartner client, “It’s tough to execute your way out of a planning problem.”

That doesn’t mean S&OP will remain static, though. With the increasing clock speed of business, increasing complexity straining current capabilities, and technological advances, it must evolve.

“It’s tough to execute your way out of a planning problem.”

- Gartner client

Gartner proposes a world where demand planning can be entirely automated, thanks to deep-learning algorithms, which in turn will enable the automation of a lot of supply planning. The number of decisions that come up for S&OP will drop off, and instead, you’ll be informed about a lot of decisions. The process goes from people-centric to decision-centric, and you may be able to “skip” straight to Executive S&OP, where the discussion is about gaps, risks, and opportunities.

3. Internal collaboration remains a challenge.

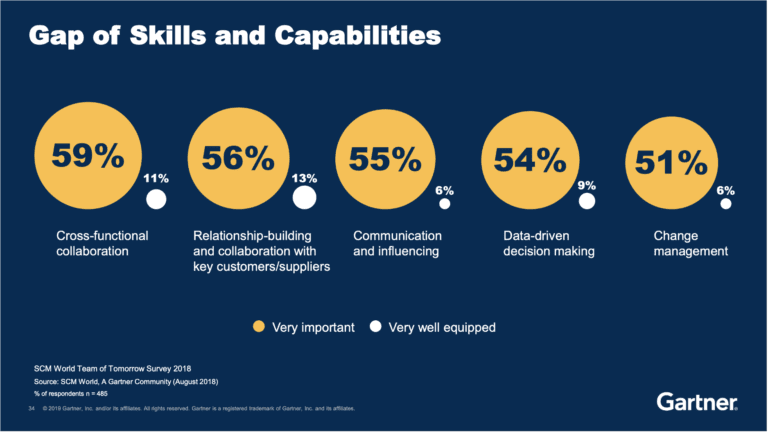

So what are the barriers to this brave new future for planning? As we see with many digital transformation projects, it comes back to culture and organizational realities:

- Culture and behavior will create inertia

- Orchestrated funding won’t be approved

- Belief in technology stalls

- Companies will still struggle with the fundamentals of S&OP

- Skills gaps

It’s easy to focus on external collaboration with customers and suppliers, but internal, cross-functional collaboration is just as, if not more, important. In Gartner’s opening keynote, A New Era – Converging Physical and Digital, they emphasized the highest performing supply chains drive collaboration from the inside out — across functions and the internal supply chain.

At Alloy, we see this point borne out in our customers’ organizations. Their supply chains excel because supply chain management is everyone’s business – not just those with supply chain in their title. VPs of Sales and their teams also closely monitor KPIs like out-of-stocks, provide strong planning input, and work collaboratively with customer supply chain to improve replenishment and availability.

4. People are a given, the environment is not.

At the 2018 Gartner Supply Chain Conference, a theme that was heavily emphasized was the need to prepare supply chain professionals for a digital future — determining their place in relation to digital technologies, ensuring they have the necessary skills, etc. While these points still applied this year, they seemed to be taken as a given that everyone was aware of, and so received less focus. We think this shift reflects an increased understanding of the benefits of digital technologies. Organizations are now less fearful of how it will impact jobs, and we are very happy to see the progress!

Instead, there was a new emphasis this year on corporate social responsibility, and specifically, sustainability. During the Gartner Top 25 Supply Chain Awards dinner, the speakers repeatedly emphasized the sustainability efforts of the companies being recognized. As mentioned above, P&G’s efforts to reduce its impact on the environment were a highlight of their industry keynote and drew a spontaneous round of applause from the crowd. In a wonderful combination of a desire to do good in the world, increasing consumer awareness and demands to protect our environment, and real bottom-line cost savings, sustainability is now top of mind for a lot of supply chains.

5. Data is the new oil.

This catchy phrase is an apt analogy. It not only speaks to how valuable data is, but how difficult and politically fraught it can be to extract.

In our conversations with supply chain leaders, technology vendors, and Gartner analysts at the conference, we kept hearing about the challenge of collecting and harmonizing data to feed tools — from demand forecasting and planning to AI-driven supply chain management. Internally, data is often spread across multiple unconnected ERPs, stretching into the dozens for the largest organizations. Externally, while retailers are sharing data as we talked about in takeaway #1, they do so in a variety of formats, each with their own product numbers and different levels of granularity.

Uncoincidentally, Alloy’s data platform is where we shine. In addition to automatically collecting data from downstream partners like retailers and distributors, our data model harmonizes and “translates” it. This modeling allows for very flexible analysis. For example, if one retailer provides daily sales and inventory but another only provides weekly data, Alloy will intelligently fill in the gaps in the weekly data. That way, teams can analyze it at a daily level and compare it to other retailers.

Logan Ensign

Logan Ensign is Chief Customer Officer at Alloy.ai. Logan — an expert in predictive analytics, AI and supply chain — works closely with leading consumer brands to help them solve their retail, e-commerce and supply chain data challenges in a way that helps them achieve their business objectives. Logan joined Alloy.ai from InsideSales.com, an AI and predictive analytics company focused on transforming sales operations.

Seven best practices for data-driven order allocation

Bring unbiased analytics to tricky allocation decisions to help maximize sales, keep customers happy and even prevent allocation situations.

4 Ways Demand Sensing & Planning Work Together

Defining demand sensing, how it differs from planning and 4 reasons for building out demand sensing in conjunction with your demand planning capabilities

What Is The Most Popular Demand Planning Software?

4 reasons Excel remains the most used demand planning tool, based on interviews with demand planners at a half-dozen consumer electronics companies