Leading consumer brands are using Alloy.ai to take Walmart Scintilla’s analytic capabilities to the next level. Discover how Alloy.ai enhances Walmart Scintilla with automated replenishment recommendations, cross-retailer data normalization, improved forecasting, deeper e-commerce insights, ERP data integrations and more — helping consumer brands act quickly to identify problems and drive revenue.

How Alloy.ai takes Walmart sales and inventory analytics to the next level

Walmart Scintilla arms consumer brands with crucial sales and inventory insights, but the highest performing Walmart teams and those looking to analyzing cross-channel data might be eager to take their analysis to the next level. That’s where Alloy.ai comes in. Alloy.ai automates data processing and provides advanced analytics on top of Scintilla, helping brands optimize replenishment, improve forecasting, gain a clearer view of e-commerce trends, spot cross-retailer trends, and more. Here are seven ways Alloy.ai enhances Walmart Scintilla to help brands make better, faster decisions.

Table of Contents

Flexible and powerful ad-hoc analysis

Walmart Scintilla provides a wealth of data as well as some handy charts and tables. But what if your question isn’t easily answered within those insights? Typically you’ll need to download multiple reports, stitch them together, and spend significant time manipulating data in Excel before you get to your answer. Imagine doing all of that with a couple of clicks.

Scintilla is best-in-class in-terms of retailer portals, but it isn’t designed to support the need for flexible deep, customized analysis. Most sales, insights, category, and supply chain teams still need to work outside of Scintilla to answer questions beyond the pre-configured insights Walmart provides.

Alloy.ai handles the data pulls for you, enables flexible ad-hoc analysis, and eliminates the manual work. Instead of being confined to pre-built charts and static reports, users can:

- Combine data from multiple reports for deeper insights

- Automatically update key analyses with the latest data

- Create custom visualizations and derived metrics with a few clicks

- Quickly drill down into trends and variances without pulling additional data

With Alloy.ai, teams don’t have to rely only on pre-built reports. They can flexibly analyze data to answer specific business questions, making decision-making faster and data-driven. In short, it’s built for the way analysts like to analyze.

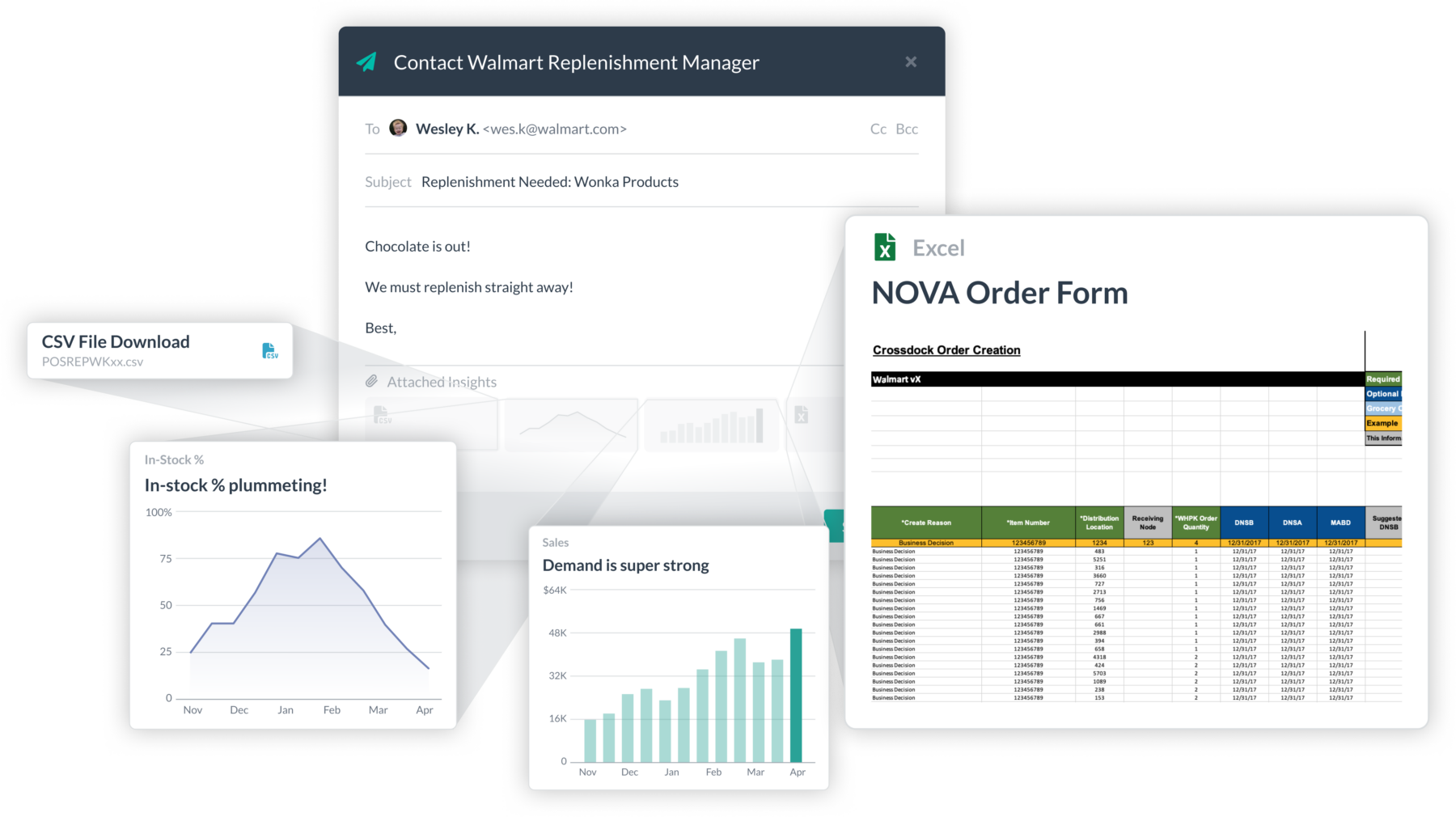

Automatic replenishment order recommendations

Walmart gives their suppliers certain tools to augment their replenishment systems. These include store-specific orders and push orders. If used correctly, these tools can improve on-shelf availability for the consumer, build trusting retailer relationships, and crucially, increase sales for your business. But figuring out when to use them, and how, takes a lot of manual data crunching.

To script a store-specific order, you need to combine data from multiple different reports in Scintilla, calculate the inventory need and then make adjustments to meet any supply chain constraints. Simply pulling all the latest data and stitching it all together can take significant time — and acting fast is critical to avoid missing opportunities or letting in-stocks get worse. It’s also important to avoid over-stocking stores, costing money in markdowns and losing your Replenishment Manager’s trust.

Alloy.ai’s Replenishment Recommendations for Walmart Suppliers module is designed to work alongside Walmart’s Scintilla and NOVA systems. It alerts you when a store-specific order could be needed, based on inventory, demand and forecast KPIs, and streamlines the script building process into a few clicks, automatically calculating recommended order quantities and applying constraints . Then it spins up an order form you can plug directly into NOVA.

Alloy.ai’s replenishment recommendations enable brands to:

- Maintain optimal stock levels to prevent lost sales

- Drive revenue through incremental orders

- Respond proactively to fluctuations in demand

By automating and improving replenishment decisions, Alloy.ai helps brands ensure Walmart shelves remain stocked with the right products at the right time. Alloy.ai customers have identified, submitted and had Walmart RM’s approve millions of dollars in incremental orders — per week.

See our replenishment recommendations workflow in action here:

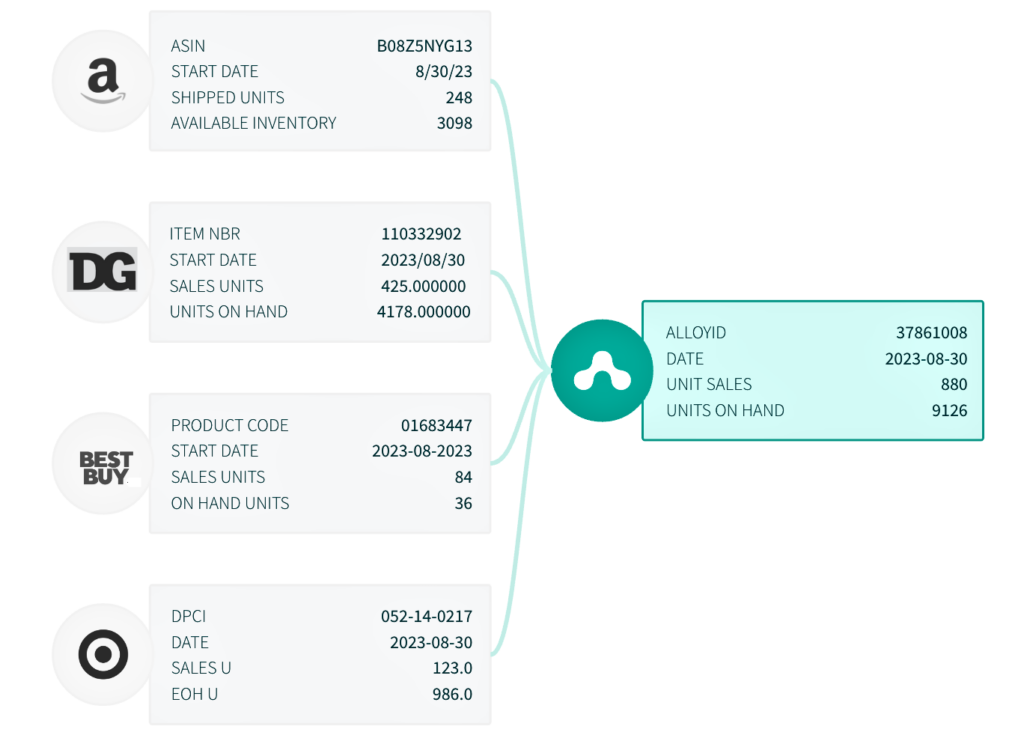

Normalizing data across retailers and channels

Most consumer brands don’t just sell through Walmart — they operate across multiple retailers and e-commerce channels. Each retailer or data source provides data in different formats, making it difficult to compare performance across channels.

Alloy.ai automatically integrates and normalizes data from Walmart Scintilla alongside data from all of your other retailers, transforming fragmented reports into a unified view.

With your data normalized by product ID, unit of measure, location and time, brands can easily:

- Compare sales and inventory performance across retailers

- Spot trends that might be hidden in siloed data

- Make more informed decisions with a complete picture of their supply chain

By providing a consistent data structure, Alloy.ai removes the manual effort of aligning reports from different retailers and enables brands to gain cross-retailer insights that drive better sales and inventory strategies.

See the kinds of cross-retailer insights you can easily surface in Alloy.ai:

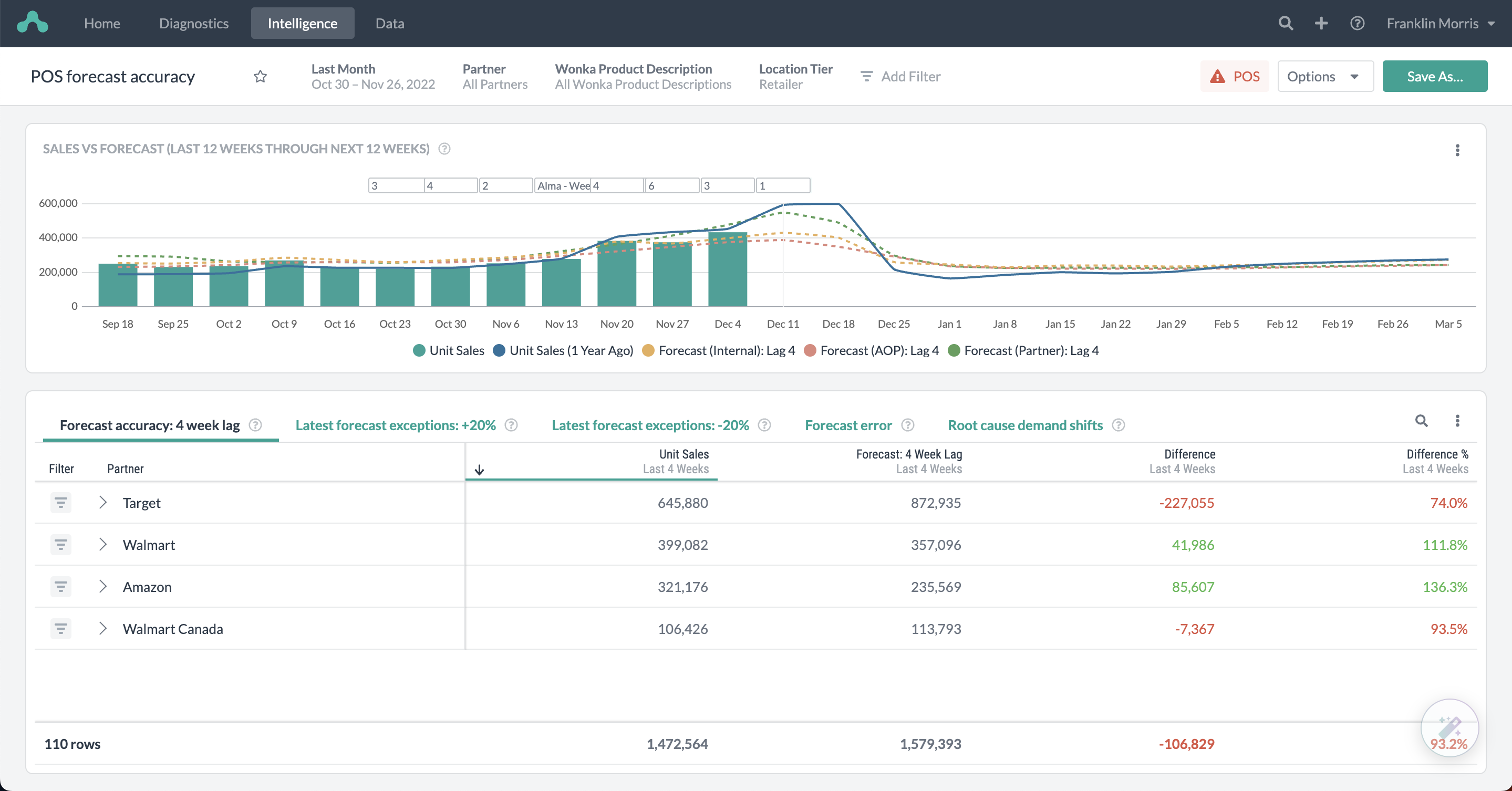

Forecast accuracy and versioning

Walmart provides two forecasts that impact replenishment — the POS store forecast and the ‘Supply Plan’ or Order Forecast. If these forecasts are inaccurate, products can quickly go out of stock or be overstocked. Alloy.ai helps brands quickly detect when forecasts are underestimating or overestimating demand. Because even best-in-class forecasts like Walmart’s aren’t right all the time. Alloy.ai stores historical forecasts and offers a range of statistical accuracy measures. Brands have a clear measure of retailer forecast accuracy and can identify specific products, DCs or regions with significant accuracy deviations, where forecast adjustments or other action may be needed. Exception alerts can highlight chronic issues over time, or recent issues as new trends emerge. Acting quickly is crucial to capture opportunity and keep shelves stocked.

POS Retail Forecast Accuracy Dashboard in Alloy.ai

Additionally, Alloy.ai allows users to compare different forecast versions, helping brands understand how forecasts are changing over time.. Get alerted when changes happen — something that Walmart does not flag for suppliers today — so you can dive into root causes and adjust your plans accordingly. Is this an expected forecast shift or something new? Are you prepared to fill these expected orders?

In the case of OTIF fines, you can look back and see if the Supply Plan changed significantly in the final weeks before the orders were placed. These insights can help dispute fines if forecasts were volatile.

With Alloy.ai, brands can:

- Spot problems with forecast accuracy and identify recommended forecast adjustments

- Compare multiple forecast versions to flag changes in retailer forecasts

- Adjust production and inventory strategies proactively

Here is a quick walkthrough of Alloy.ai’s Retailer Forecast Monitoring dashboard:

Handling data quirks and restatements

Retail data often requires interpretation due to occasional adjustments, delayed updates, or reporting shifts. Walmart Scintilla provides extensive data, but keeping up with changes can be challenging. Alloy.ai helps brands detect and adjust for these changes more efficiently.

Examples of data “quirks” Alloy.ai can identify and help manage include:

- Restated Sales Data: Sometimes sales numbers are updated after initial reports due to late transactions or adjustments. Alloy.ai tracks and updates data automatically to ensure reporting accuracy over time.

- Data delays: When certain data in certain reports is delayed, it’s easy to waste time checking back to see when it’s available. Alloy.ai provides a live data status across your different data feeds and reports, and can alert you when new data is available.

- Phantom Inventory: A product may appear in stock according to data but be unavailable on the shelf. Alloy.ai can highlight discrepancies between sales velocity and inventory levels to flag potential phantom inventory issues.

By automatically detecting these quirks and normalizing the data, Alloy.ai ensures that brands have an accurate and reliable view of their business performance. This allows teams to act confidently on the insights derived from Scintilla without the need for constant manual data reconciliation.

Understanding ecommerce trends

Alloy.ai enhances e-commerce insights by integrating store-level service channels (such as ‘Pick up’ (BOPIS), ‘Delivery’ & ‘Ship from Store’) alongside store fulfillment metrics (such as ‘nil pick rate’). Brands can gain a deeper understanding of consumer purchasing behavior, and understand how these patterns change in response to promotions or low on-shelf availability.By offering configurable metrics and flexible analytics, Alloy.ai equips brands to go deeper into e-commerce data, capturing emerging trends and optimizing omnichannel performance.

Key benefits include:

- Nil Pick Analysis: Dig into true on-shelf availability in stores, where in-stocks may not tell the full story.

- Segmented e-Commerce Data: Understand trends in digital penetration and how consumers are buying, by combining all types of e-commerce data from different reports

- Lost Sales Attribution: Track lost sales in relation to out-of-stock incidents and service channel trends, enabling targeted supply chain adjustments.

Connecting ERP and retail POS data to unlock new insights

There is no better way to align supply and demand than to analyze POS and channel inventory data alongside order and inventory data from your ERP. Unfortunately there is no way to do this within Scintilla — at a minimum this will slow your analysis down, and you may also miss crucial insights uncovered by marrying these two data sets.

Alloy.ai bridges this gap by allowing brands to seamlessly combine their ERP data with retail insights, unlocking powerful new capabilities for decision-making:

- Inventory constraints & order allocation: Brands can determine whether they have enough inventory to fulfill Walmart orders before writing scripts, preventing hits to your OTIF rates.. If inventory is limited, Alloy.ai will allocate available stock strategically across locations.

- Drill into inventory issues: Instead of jumping between systems — or, gasp, exporting everything into Excel — brands can now analyze store-level supply issues alongside their ERP-stored supply levels and PO data, making it easier to diagnose and address inventory shortages or overhangs.

- Avoid OTIF fines and improve service levels: Meet your supply chain KPIs by making informed decisions on production ordering, expediting production, allocation or transfers with visibility into ERP movements and retail supply levels in one place.

By centralizing ERP and retail data within Alloy.ai, brands break down data and organizational silos, speed up analysis, and make more data-driven decisions that directly impact their bottom line.