Alloy.ai Consumer Goods Index – May 2023 Edition

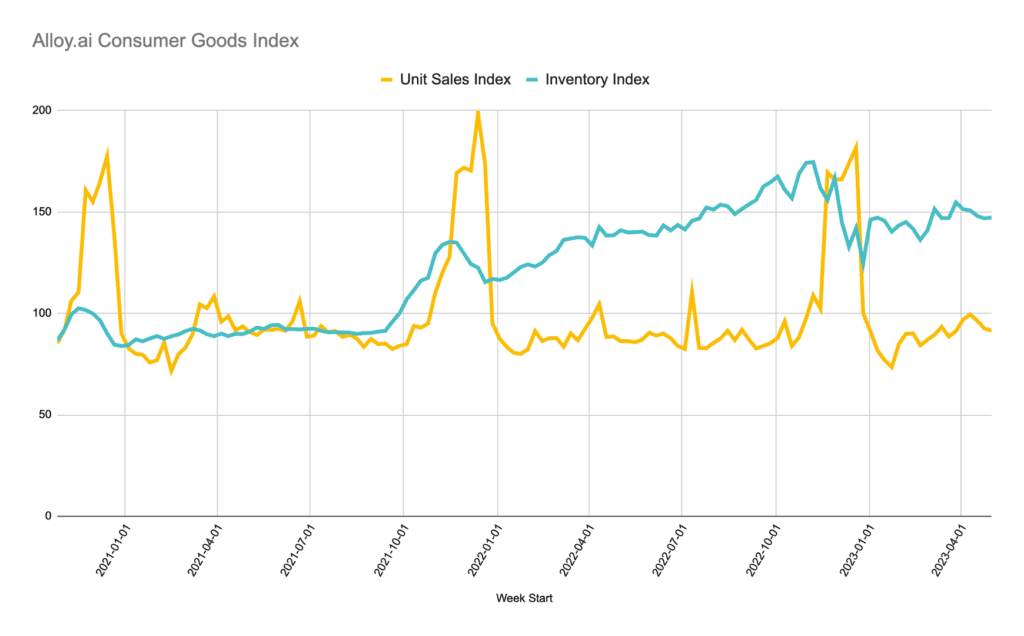

Deltas in sales over time and inventory totals are critical leading indicators for the health of the consumer goods industry. Retailers and consumers alike are impacted by deviations and volatility in the consumer goods supply chain. The Alloy.ai Consumer Goods Index tracks 40M SKU-location combinations across both retail and ecommerce, giving a view into sales and inventory trends across industries. Use this data to understand the trends, isolate the impact of wide-scale events and predict future peaks and valleys.

Note: All consumer goods data within this dashboard has been generalized to protect the anonymity of the companies involved.

Table of contents

Alloy.ai Consumer Goods Index — May, 2023

Consumer goods trends in May, 2023

Easter unit sales were down

Average unit sales the week of Easter 2023 were down ~7.25% year-over-year. However, this year’s average unit sales were on par with 2021’s unit sales, suggesting that consumers were less price sensitive during Easter 2022 but have now begun to reign in spending as economic uncertainty becomes prevalent.

Month-over-month unit sales increased

Unit sales during the month of April were more than 6% higher than during the month of March. This increase may be attributed to seasonality, as a 7.5% increase was seen during the same period in 2022. However, the upward trend is encouraging in an economy braced for a downturn.

Excess inventory rates remain high

Average inventory rates during the month of April 2023 are nearly 8% higher than during the same period in 2022, and up 65.5% since April 2021. Trending inventory rates have returned to the levels seen during the back-to-school season in the fall after a temporary reduction following the 2022 holiday shopping season. Chronic excess inventory issues are contributing to lower-than-expected earnings for retailers and brands alike as costs are passed along to consumers.