- Franklin Morris

Follow these steps to ensure the right product is on the shelf when and where a shopper wants it, so your brand never misses out on a sale.

1. Identify specific instances of OOS (out-of-stocks) or phantom inventory

By analyzing granular POS and inventory data provided by your retailers, you can identify OOS and phantom inventory at the SKU-location level. Uncover phantom inventory at stores with inventory but no sales outside of the expected range. For unresolved OOS, you should look at stores sold through for two weeks with no inventory on-order.

2. Quantify your losses

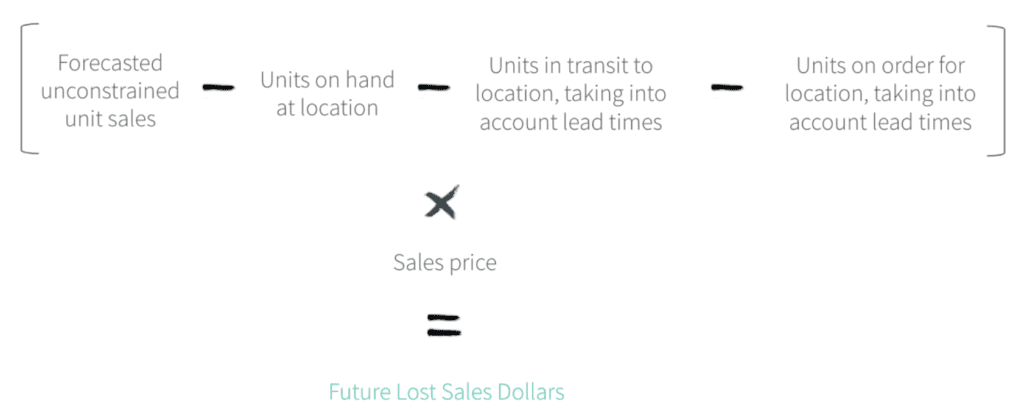

Quantifying losses is key to motivating your partners and necessary to prioritize where to focus. Saying “you’re losing $124,450 every week” is much more powerful than saying “you’re 3.2% out-of-stock,” even though they’re both true. One common way to calculate lost sales uses historical sales or a POS forecast to estimate what demand would have been if you had been in-stock (also known as unconstrained demand) and current inventory levels.

3. Prioritize based on value-at-risk

Lost sales are expected in a retail environment, but by focusing on the SKU-location instances where you stand to lose the most, you can significantly mitigate your losses. Filter based on the magnitude of lost sales so you can drill down deeper to diagnose the most valuable opportunities.

4. Diagnose the root causes

A wide variety of factors can cause lost sales, but you likely know your most common ones. Start with a hypothesis and test it as you pinpoint what’s going wrong. Perhaps your retailer’s replenishment schedule or forecast is off? Maybe you’re experiencing a recent demand shift that your retailers haven’t reacted to yet? Comparing actual sales against your retailers’ forecasts, inventory positions and order patterns will help you reveal the problem.

5. Identify the solutions

Based on the root cause, you can evaluate the right actions to take internally and to recommend to your partners. These solutions often require acting on multiple time horizons across multiple data sets. Say you determine your forecast was too low and your retailer was under-ordering. You need to both adjust your demand plan and ensure your retailer orders more now to meet near-term demand. That’s the solution this leading fitness equipment maker identified for their customer.

6. Use data-driven storytelling to deliver your recommendations

Retail buyers prioritize brands that support their recommendations with data and analytics. Package your insights into a data-driven narrative that highlights the cost, root cause and specific actions they need to take and share it with your retail partner. In some cases, you may even be able to drive action yourself, like with a store-specific order (SSO).

7. Follow up and measure progress

After your actions have been implemented, analyze their impact using historical data. What would lost sales have been if you had been OOS for another week? Continue to communicate those insights to external and internal partners to close the loop and continually build trust.

Franklin Morris

Franklin Morris is Vice President and Head of Global Marketing at Alloy.ai. He's spent his career leading brand, content and demand generation marketing for high-growth startups, ad agencies, and Fortune 50 giants, including IBM, Dell, Oracle, Rackspace, 3M, Facebook, Electronic Arts, Informatica, Sisense, and Argo Group.