Consumer Goods Hub

Everything your brand needs to know to grow your sales

Everything a consumer brand needs to grow: sales channels, retail partnerships, eCommerce, omnichannel strategy, and operational playbooks — no fluff.

August 13, 2025

post

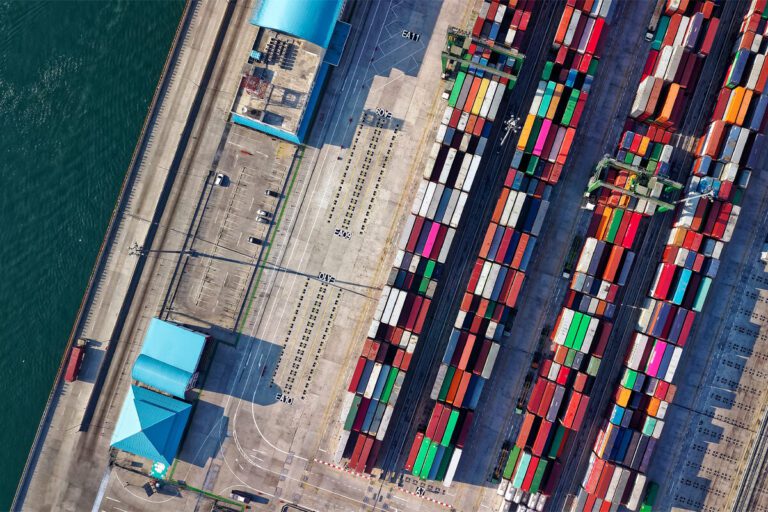

- Data, Sales & Performance, Supply Chain

Shelf Life Podcast

Expert Voices from the Consumer Goods Industry

July 1, 2025

- Data, Ecommerce, Retailers, Sales & Performance, Supply Chain

May 26, 2025

- Retailers, Sales & Performance

March 12, 2025

- Data, Supply Chain

February 8, 2025

- Data, Supply Chain

February 7, 2025

- Data, Supply Chain

January 28, 2025

- Data, Supply Chain

December 18, 2024

- Supply Chain

September 13, 2024

- Data, Retailers, Supply Chain

October 4, 2023

- Data, News and Trends, Supply Chain

September 27, 2022

- Data